I will try to provide the outline of a long thesis as succinctly as I can. Someone has a more thorough write-up here (paywall).

Thesis Sketch

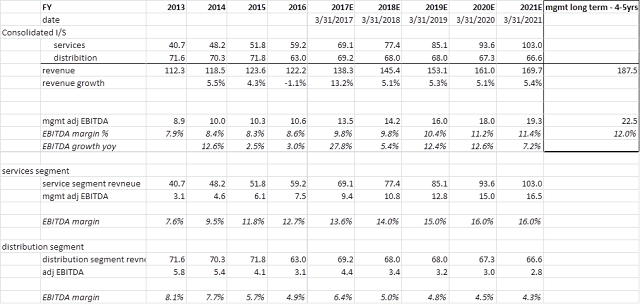

Transcat can double its EBITDA in 3-5 years, and the stock can double as well. The reasons are below:

- The company has 2 segments, one growing and one declining/stabilizing. Revenue growth is set to accelerate because the growing segment is now outpacing the declining one.

- Growth is further enhanced by a roll-up strategy in its services segment (in addition to organic growth)

- Margins will benefit from mix (Services segment has higher margin), as well as operating leverage.

Mix Shift Toward Higher Growth and Higher Margin Segment

The company has 2 segments: Services and Distribution. Right now they contribute about 50/50 in terms of revenue. The Services segment has been a steady grower (both organic and via acquisition). Distribution segment revenue declined the past few years due to the oil and gas industry downturn, but seems to have stabilized in the past few quarters.

Going forward, the growth in Services will outpace the decline in Distribution. Since Services enjoys a higher EBITDA margin (low double digits vs mid-single digits), EBITDA will grow faster than revenue.

The slide below shows the revenue and profitability crossover.

Roll-Up Strategy

The Services segment is also a rollup story, supported by reasonable debt levels (~2x Debt/EBITDA). The company is a disciplined acquirer, typically paying 4-6x EBITDA with IRR hurdle of 15%.

Calibration services is an $1bn market, split 40%/35%/25% between 3rd party services providers, in-house labs, and OEMs. Within ~the $400mm market for the 3rd party services provider, Transcat is the 2nd largest with behind Tektronix (18% share versus 22% share).

Notably, almost 40% of 3rd party providers market is serviced by smaller regional and local players. That’s a ~$160mm space that Transcat has been, and will continue to be consolidating.

I believe the company can improve its share of that 3rd party market from 18% to low 20%’s, providing a tailwind for revenue and margins.

Valuation

With TRNS stock trading at $12.4/share, the company has $89mm of market cap and ~$115mm of enterprise value.

Management is targeting $175-200mm of revenue and double digit EBITDA margin in 4-5 years. Using the midpoint of $187.5mm revenue and a 12% margin gets you to $22.5mm EBITDA. With a 10x EV/EBITDA and you have $225mm of enterprise value – almost a double from the current $115mm EV.

That is in 4-5 years. But as markets are forward looking, I expect the stock to double sooner.

Here’s my rough model on 1) how revenue and EBITDA might progress over the next few years to FY2021, and 2) what they look like if management’s goals are met.

The 2 are fairly close so I think management’s goals are reasonable. Recent financial results suggest they are well on their way.

Really wonderful information Thanks for sharing....

ReplyDeleteOTDR