R1 RCM (formerly Accretive Health) is a high probability trade with >2:1 upside/downside. The stock is trading at ~$3.3/share and I can easily see this going to $5 if not more. This is an idea that’s been on the radar for years. Here are just a few write-ups that helped along the way.

2014: From Buyside Notes

Also late 2014: write up by Sententia Capital

2016: mentions by Reminiscences of a Stockblogger

So why another write-up? This is now a material position for me and I owe myself a write-up for documentation. Also, given the recent run up, it would be helpful to explain why the stock can go a lot further, as well as provide some valuation ranges.

R1 RCM (formerly Accretive Health) does revenue cycle management for hospitals. I won’t bore you with what that means - that’s covered by the various write-ups I cited above. In any case I’m not enamored by the business. Basically I’m investing in the stock, not the business.

A few years back company had accounting/customer issues which caused delisting. They fixed those problems and just re-listed. The ugly history, customer concentration, combined with (still) ugly accounting and capital structure all combined to discourage investors and create this opportunity. I know that because for the last 3 years every time I looked at the company I thought “yuck” and skipped, until recently the opportunity simply became too good to resist.

Cheap Valuation Relative to High Probability of Delivery Next 3-4 years.

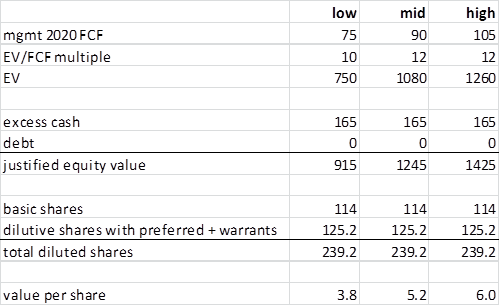

Management has a 2020 plan for free cash flows of $75-105mm by 2020. They expect to be free cash flow positive by 2H17.

Notably, management stated that currently contracted business alone would deliver 90%+ of the low end of that 2020 projection.

Capital structure is messy but not crazy once you work it out. Here are the basics.

- $181mm of cash, but ~16mm of that is “customer float”. So excess cash is about $165mm

- $0 debt.

- $214mm of Convertible Preferred’s that Pay-In-Kind (PIK) at 8%, convertible at $2.5/share.

- 60mm shares of warrants convertible at $3.5.

- Cash and debt. The company will be cash flow positive by 2H17, so I give them credit for the full $165m cash at 2020, and still no debt.

- Convertible Prefs. $214mm at 8% quarterly compounding get you to ~$295mm by 2020, which at $2.5 conversion price get you about 118mm dilutive shares at 2020.

- Warrants: I used treasury stock method, assuming warrant holders exercise at $3.5/share, and then company buy it back at higher average price of $4/share (just to have some conservatism built in). This gets us 7.5mm dilutive shares.

So here’s what valuation looks like. Using conservative EV/FCF multiples of 10-12x, RCM should be worth $3.8-$6.0 per share by 2020.

Given today’s stock price of about $3.3, there is no downside, while the mid-point of that valuation range provide almost 60% upside and ~20% IRR

This is almost too good to be true. At what point would I say “I may be wrong, let’s cut out and re-evaluate”? There appears to be some support around $2.4. Using that as a stop loss, downside is about 30%. Compare that to 60% upside that’s a 2:1 reward to risk ratio.

Again, this is a high probability given that currently contracted business delivers 90% of the low end projection. God forbid they actually win new contracts, the shares could go through the roof.

Catalysts

1) The recent listing has brought increased volume and the stock is already trending higher.

2) Company will go through an accounting change 1Q17 to simplify the story.

Right now the accounting is a mess: GAAP revenue is completely meaningless, so investors have to rely on management’s non-GAAP measures. I remember spending lots of time reconciling GAAP revenue and EBITDA to management's corresponding gross and net "cash generated from customers", and then from that to GAAP cash flow from operations and management's free cash flow measure. It was a super pain in the ass. A simpler GAAP accounting profile would go a long way to remove the “yick” factor and bring in investors.

3) If they win a contract outside of Ascension and Intermountain, that could "prove" their capability and help the story.

3) If they win a contract outside of Ascension and Intermountain, that could "prove" their capability and help the story.

I think they can do it. The company offers a fully outsourced model where they effectively take the risk of cost overrun and reap the rewards of cost savings. I think that makes a lot of sense in today's hospital landscape where margin is tight, and where payers pushing "value based care" are pushing risk into hospitals.

Other notes

Dr. Rizk served as the Chief Executive Officer of Accretive Health, Inc. from July 21, 2014 to May 26, 2016. It’s likely he left voluntarily because 1) he became CEO of Verisk Health (now Verscend) in Aug 2016, like 3 months later 2) they groomed Flanagan as COO for a while.

Maybe some analysis on whether this mgmt forecast can be relied upon?

ReplyDeleteyes I probably should have included that in the write up. Whats the likelihood of management hitting their plan?

ReplyDeleteMaybe the question is how they can NOT hit the 2020 plan, when currently contracted business delivery already 90% of the low end projection. Clearly, that implies losing existing customers during contract renewals AND failing to grab the various growth opportunities. On the former - I think the renewal of Intermountain (2nd largest customer) and growth of PAS offering validates their ability to add value and retain clients. On the latter, there should be plenty growth opportunities given their different operating model, especially while the RCM market is still growing.

That should take care of revenue. On the margin/FCF side, given enough scale, it makes sense that technology automation and shared services can lead to improve margins

There's always macro/industry level uncertainty - labor cost can go way up, Obamacare could repeal and hurt hospitals ...etc. I think using a lowly 10-12x EV/FCF multiple should account for that

Despite all that, there's even buffer for them to miss target - even the low end of my valuation here represent upside for the stock. Management would have to really mess up to for stock to fail - low probability.

I'm have not seen red flags on management incentives either - no expert here but just a cursory look shows CEO Flanagan owning 1.3mm shares - no chump change. RSU vesting schedule shows they're only 75% vested by 2020

Given the new management and lousy corporate history I can understand the skepticism, but as an equity investor you get paid to live with these uncertainties

If someone has a strong case why the probability of hitting management plan is <50%, i'd be happy to know

Isn't the problem here massive customer concentration, with all that it entails? Last year Ascension was 78% (not a typo) of revenue. Doesn't Ascension have all the leverage here? If they do it would explain why they had to issue all the dilutive securities to Ascension to strengthen the "MPSA". Is Ascension going to bring the hammer down again in 8 or 9 years when the contract comes up for renewal?

ReplyDeleteyes they are also the owner and that helps

DeleteYes, but Ascension doesn't own 100% of RCM and, as such, is probably incentivized to extract their pound of flesh at the minority shareholders' expense. For example, RCM is sitting on a ton of cash, did they really need $200M in early 2016, or was the ugly preferred security and warrant deal de facto compensation for Ascension's continued patronage?

DeleteI'm probably not making my point very well, but I hope you see where I'm trying to go with this.....the true economics of the business may not be as good as they at first appear to be.

Hi Austin, thanks for commenting. I get what you're saying. I also think its clear to both of us that this is not some high quality Buffett business you buy and hold forever.

ReplyDeleteFrom a pure probability/risk/reward perspective though, it's still hard to see them not hitting that 2020 plan. They would not only have to lose existing customers (one is their biggest investor, another just renewed), but also not gain any new customers in a growing market. It seems to me the biggest risk is just executing on cost - which they have some control over. Dilution I already factored in.

I don’t know if you worked out a downside case? I did another downside case to assume Ascension playing hardball in 2026. That means by 2020, the contract still have 6 years left. Put a 7x FCF multiple on this (the chance of them renewing Ascension is still more than 0) I still get ~3/share. In the write-up I actually use $2.4 as downside - and that’s probably about right b/c if you go below that there's no more convert pref dilution.